Spoiler Alert: This is one of a series of articles we’re pulling together that gives context to Acts 2 and 3 of Mike Bartlett’s Love, Love, Love. If you haven’t seen the play yet, you might not want to learn some of the subjects the play follows in its later acts.

The following are excerpts from a 2017 Huffington Post UK report from Resolution Foundation. The gloss is in the article title: “Baby Boomers Hoarding Half of Britain’s Wealth While Young are Worse Off, says Think Tank”

“In the 20th Century, a predictable economic pattern emerged in the UK: Each new generation's income grew at a pace of roughly 50% more than their parents' did. From 1881 onwards, Britons only became more prosperous as the decades went by. Every parent could expect their children to do better than they did. But data published on Monday by the Resolution Foundation show that for the first time in more than 100 years the current generation of workers — millennials — are doing worse than the generation before them, Generation X. Generational income growth has stopped.”

Statistics from the Resolution Foundation report

A 2017 report from the Resolution Foundation shows in detail how those born between 1946 and 1950 are sitting on a fifth more wealth at age 65 than the cohort born just five years before.

Those born in the late 1950s – now approaching retirement – had 7% less wealth at the age of 55 than those born five years earlier did at the same age.

The Resolution Foundation believes the housing boom of the 1990s and 2000s was a key driver for baby boomers’ wealth as homeowners flourished.

Laura Gardiner, senior policy analyst at the Resolution Foundation, said: “Britain’s pre-crash property boom created a huge, unearned and largely tax-free £2.3tn housing wealth windfall for those old enough and lucky enough to be home owners at the time. But while the property bubble hugely benefited many of Britain’s baby boomers, it has also driven generational wealth progress into reverse by pricing younger people out of home ownership.”

Baby boomers, people born between 1946 and 1965, will on average earn £740,000 during their lives, according to the Resolution Foundation.

Generation X, those now aged between 35 and 50, are projected to earn 13% more than that: £835,000 on average.

But the figure for Millennials, the under-35s, is lower than that: they are forecast to earn £825,000 over their working lives.

“The proportion of 25-34 year olds in the UK who own their own home was 67% in 1991, but had declined to 36% by 2013-14. The trend was even more striking for those aged 16-24, where home ownership has declined from 36% in 1991 to 9% in 2013-14. No wonder that the under-50s own only 18% of the UK’s property wealth.

“By contrast, older generations have been very effectively sheltered from the economic headwinds. The over-60s are the only age group to have become better off since 2007/08. From 2010 to 2015, the average British household saw its income fall by about £500 as a result of tax increases and spending cuts, yet the average two-pensioner household took a hit of just £23” —“Bridging the generational divide in the UK,” 2017, OECD

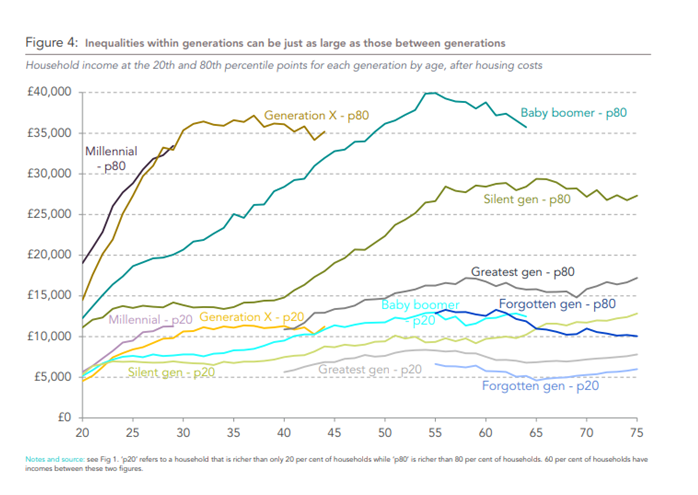

That said, here’s a chart from the Intergenerational Commission in 2017 that shows inequities within generations (here the upper 20% of income earners (80p) and the lowest 20% of income earners (20p)) are wider than the gap between them

Sources as cited; commentary by Studio’s Literary Director, Adrien-Alice Hansel